Generative AI for Process Optimization

AI solution for optimizing internal processes

Fintech

Web

5 months

Web development

Project Idea

A US-based insurance company came to us with a need to enhance operational efficiency and customer satisfaction. The company decided to use generative AI to optimize various processes. The focus was on automating routine tasks, improving underwriting processes, and streamlining claims management. Our task was to create a solution for internal usage that would help facilitate the optimization process.

The client had

Idea

Desired feature list

We were responsible for

UX/UI design

Backend development

Frontend development

Ongoing maintenance

Features in detail

Automated underwriting

The platform uses generative AI to analyze historical underwriting data, assess risk factors, and generate optimized underwriting models. This resulted in quicker and more accurate policy decisions.

Claims processing automation

We implemented natural language processing (NLP) algorithms to analyze and extract relevant information from claims documents, automating claims validation and processing.

Predictive analytics

Generative models predict potential fraud cases, estimate claim amounts, and optimize pricing models for insurance policies.

Customer interaction chatbots

We developed AI-driven chatbots to handle routine customer queries, policy inquiries, and basic claims status updates that reduced the workload on customer support teams.

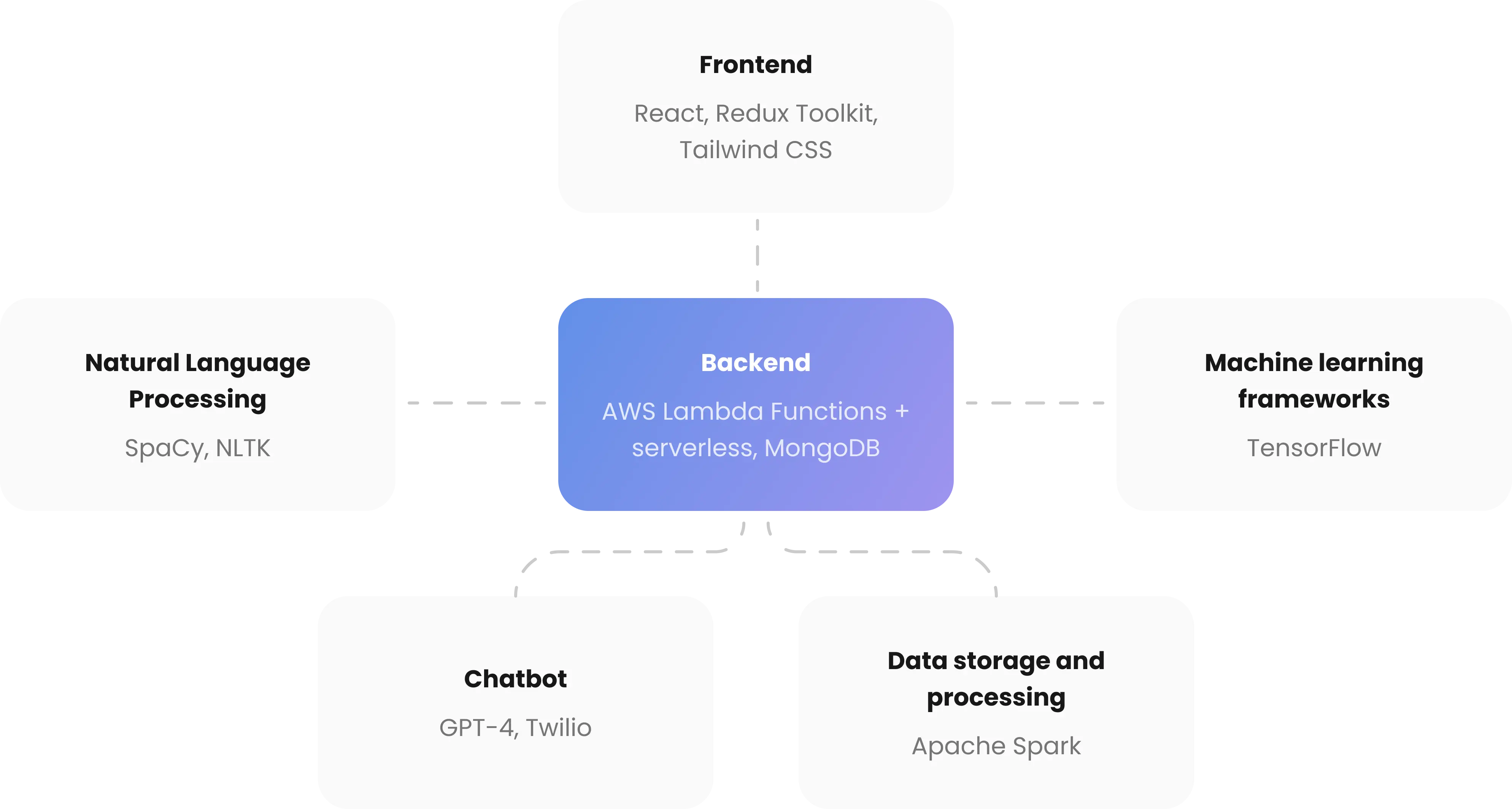

Tech stack

What technologies did we use to create the solution?

Development challenges and solutions

How our team dealt with a range of development challenges.

Data quality and availability

Challenge: We needed to ensure that there is no incomplete or inconsistent historical data for training AI models to avoid any mistakes in future outcomes. Solution: We implemented a robust data cleaning process to make sure that all the data passes the quality assessment. We also augmented the missing data with generative techniques.

Integration with the legacy system

Challenge: We needed to integrate the new solution with the legacy systems the company had already been using. Solution: With the help of various APIs, we enabled smooth communication between the new AI components and existing systems.

Results

The solution is up and running.

The underwriting process is more efficient.

Claims processing time is reduced.